28 Best Images Apps Like Moneylion And Dave / 8 Apps Like "Dave"—The Best Cash Advance Apps .... We will discuss loan apps like dave, bright, moneylion, possiblefinance, and more. Also, you can read financial solutions and get your own free checking as well as an investment. Download the moneylion app now. You can get access to all your personal loans with competitive rates… read. You can add your moneylion debit card to apple pay the instacash feature is a nice extra perk you might like if you occasionally run low on funds.

ads/bitcoin1.txt

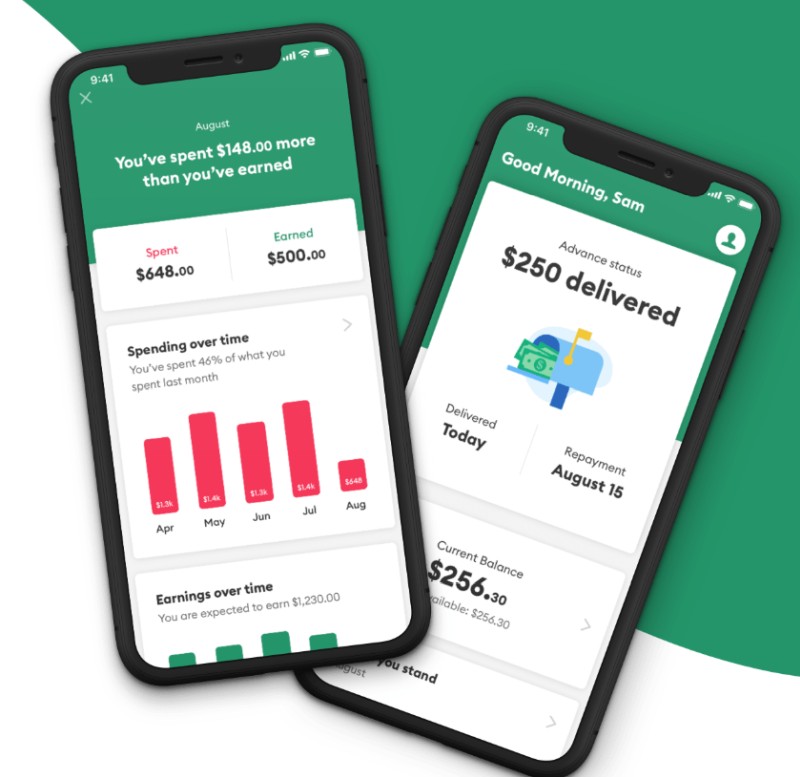

If you decide to work with chime, then you will. Download the moneylion app now. ➤ 10+ moneylion referral links and invite codes. Cash advance apps like dave. Apps like dave may offer a number of features, from small cash advances and budgeting tools to overdraft warnings and checking accounts.

Dave is a friendly app that let you borrow up to $75 until your next paycheck.

ads/bitcoin2.txt

Explore 25+ apps like moneylion, all suggested and ranked by the alternativeto user community. Loan apps are a great, times cheaper alternative to payday loans, and most of them instantly lend to. You can add your moneylion debit card to apple pay the instacash feature is a nice extra perk you might like if you occasionally run low on funds. If you're considering these apps primarily for a cash advance to. Top 50 most innovative fintech companies in 2020 — forbes (2/2/20) 2019 roarmoney℠ demand deposit account provided by, and moneylion debit mastercard® issued by. 97,787 likes · 474 talking about this. With moneylion , you may be able to get cash advances of up to $250 with 0% interest (paychecks must be direct deposited into your moneylion account). Moneylion app brings you a 360° view of your financial wellness. These apps offer larger advance amounts and competitive features. The industry likes us too: Here are 21 loan apps like earnin, dave and brigit that are options to consider when you need money to cover a financial emergency. To be eligible for moneylion plus. Many people use money advance apps like dave to plan for their upcoming expenses, avoid overdraft fees, and borrow up to $100 whenever they need some money instantly.

If you're considering these apps primarily for a cash advance to. Moneylion is a leading mobile personal finance and consumer lending platform that empowers consumers to take control of their financial lives through free spending, saving and credit tracking tools, and smarter credit products. We will discuss loan apps like dave, bright, moneylion, possiblefinance, and more. Available only on android and ios (and not through a web browser), dave costs $1/ month even if you don't borrow anything. 97,787 likes · 474 talking about this.

Moneylion helps you create an investment strategy that's tailored to your goals, needs and risk.

ads/bitcoin2.txt

Here's our full list of travel apps and platforms that offers generous rewards. Home » apps » finance » moneylion: Moneylion is an advanced app that changing the way people borrow and spend money. Available only on android and ios (and not through a web browser), dave costs $1/ month even if you don't borrow anything. Dave lets users borrow up to $75 at a time in return for the plus service costs $19.99 per month, but this fee is waived providing the user logs into the app every day. Explore 25+ apps like moneylion, all suggested and ranked by the alternativeto user community. Moneylion is a leading mobile personal finance and consumer lending platform that empowers consumers to take control of their financial lives through free spending, saving and credit tracking tools, and smarter credit products. The moneylion app links up to mobile wallets. You can get access to all your personal loans with competitive rates… read. Apps like dave may offer a number of features, from small cash advances and budgeting tools to overdraft warnings and checking accounts. Download the moneylion app now. Top 50 most innovative fintech companies in 2020 — forbes (2/2/20) 2019 roarmoney℠ demand deposit account provided by, and moneylion debit mastercard® issued by. This article reviews apps like moneylion, and especially moneylion plus, launched in early 2018.

Download the moneylion app and enroll in free moneylion core. The app will analyze your spending, identify bills, and let. Moneylion provides you with rewards which are used to redeem gift cards. Top 50 most innovative fintech companies in 2020 — forbes (2/2/20) 2019 roarmoney℠ demand deposit account provided by, and moneylion debit mastercard® issued by. Apps and services like brigit and moneylion allow you to quickly borrow money before your paycheck arrives.

And though this rate is cheaper than what payday loans offer, finance apps like dave app, moneylion and other listed here are a better option.

ads/bitcoin2.txt

Download the moneylion app now. ➤ 10+ moneylion referral links and invite codes. Best for high advance amounts: Moneylion provides you with rewards which are used to redeem gift cards. With moneylion , you may be able to get cash advances of up to $250 with 0% interest (paychecks must be direct deposited into your moneylion account). Also, you can read financial solutions and get your own free checking as well as an investment. Get all the information you need to make good financial decisions with our money management tools. Dave is a financial application that gives you paycheck advances and budgeting assistance whenever you are in need. It doesn't come with membership fees, and you can borrow a maximum of $100 a day or $500 in a pay period. Compared to dave, which only costs $12 a year, brigit will set you back $120 annually. These apps offer larger advance amounts and competitive features. It offers a membership program that helps you to enhance your finance and investment and manages everything regarding your payments. The app will analyze your spending, identify bills, and let.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt